You should never ignore a notice of levy, a notice of federal tax lien, or any other notice or demand from the IRS. If you do so, it is at your peril. - One way to respond is to request an installment agreement. There are basically two types of installment agreements. - The first is an ordinary installment agreement, and the second is a partial payment installment agreement. - At its heart, an installment agreement is essentially an agreement between you and the IRS in which the IRS agrees to suspend collection while you pay the balance. - In the case of an installment agreement in full, you agree to pay the full amount of taxes, penalties, and interest but at a specified amount on a monthly basis. - Usually, the IRS will demand that you pay for a term of 60 months or approximately one-half of the remainder of the statute of limitations. - The objective of both types of agreements is to avoid seizure of your income or assets by the IRS. - An installment agreement is one of the simplest and easiest ways to prevent liens, levies, or loss of your assets. - Under a partial payment installment agreement, you agree to pay an agreed amount based upon your demonstrated ability to pay in monthly payments. - The amount you pay is determined by a means test based on national and regional standards. - The total amount you pay is simply multiplying the monthly payment times the remaining months under the statute of limitations. - The statute of limitations for collections is ordinarily ten years or 120 months from the date the taxes are assessed. - To find out the exact date that the tax was assessed, you can obtain a copy of your transcript from the IRS. On the transcript, it will indicate when the tax return was...

Award-winning PDF software

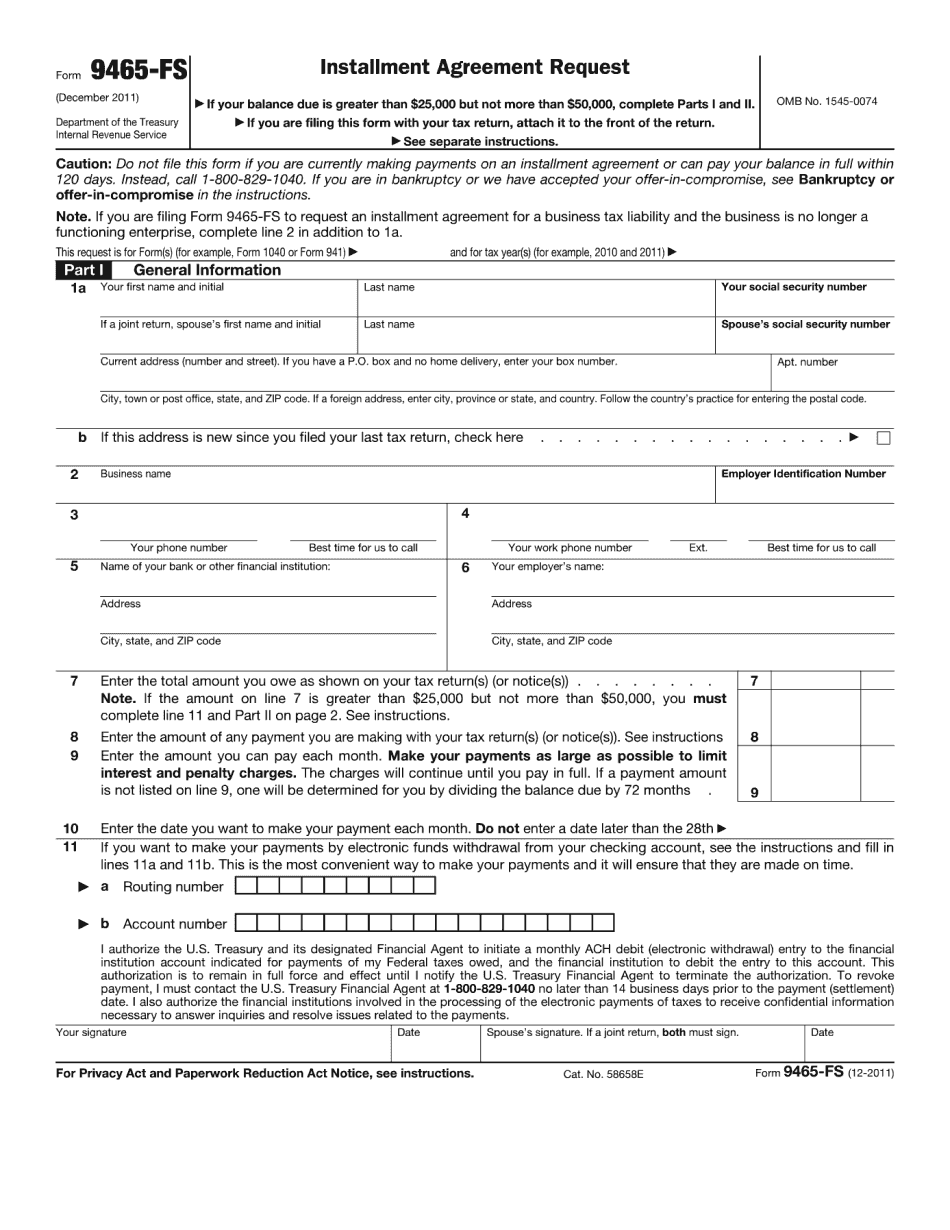

9465 Form: What You Should Know

Use IRS Form 9465 Installment Agreement Request to request a monthly installment plan if you can't pay your full tax due amount (but you can pay the amount shown on your tax return or the amount that was shown on the notice sent to you). You are in full compliance with all of your tax obligations, so you should not need to file Form 9465. The IRS allows installment payments of a portion of any tax debt, however, tax debt cannot exceed the amount shown on your tax return for the year. This rule applies to all taxpayers. Use IRS Form 9465 Installment Agreement Request and IRS Notice of Payment of Tax to request a monthly installment plan if you cannot pay your full tax due amount. You are fully compliant with all of your tax obligations, so you may need to file Form 9465. The IRS allows installment payments of the first 50,000.00 and a portion of 50,000.00 of tax debt, however, tax debt cannot exceed the amount shown on your tax return for the year. Go to IRS Notice on What You Can Do If You Cannot Pay Your Tax Debt. Form 7438: Notice of Tax Error The Notice of Tax Error (NOTE) is used to request an explanation of a tax or penalty you failed to pay on time. The IRS has a list of the most common tax error notices. You may need to file an NOTE if you know that you did not pay any tax or penalty that is due. The IRS encourages you to contact your tax professional to discuss any tax-related error that might arise. Go to IRS: Notice of Tax Error for instructions and the latest information. What Kind of Tax Error Notice Must I Have to File Form 7468? A tax error notice for failure to pay any tax is a non-statutory form that you can file online. The NOTE is an administrative method for requesting explanation. Form 7446: Payment of Refunds (Failure to File) You may not have to file an NOTE if you did not file Form 14422 or 14423. However, filing an NOTE will delay processing of your tax refund. In addition, if your tax refund is reduced because of an NOTE, all additional federal income tax you owe may not be included in your refund.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9465-FS, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9465-FS online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9465-FS by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9465-FS from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 9465 form