So if you find yourself in a position where you file your tax return and you owe a large amount of taxes to the irs and you can't pay it there are options right the irs does have pretty standard form streamline installment agreement requests for taxes owed okay so you know i see this very frequently with self-employed individuals all right because if you're an employee your employer is taking taxes out of your paycheck every week and so at the end of the year you either get a refund or you might have a little extra oh but it's nothing too surprising when you're self-employed you're responsible for making estimated payments on behalf of yourself right and so a lot of taxpayers won't make any estimates they won't save for taxes so at the end of the year they complete their schedule c or they drop in you know a k1 from a 1065 or an 1120s and they've got this massive tax bill and they can't pay it happens all the time if that does happen to you definitely go with an installment agreement request it's you don't want to ignore the taxes you know if you have a balance owed and you wait the irs will just send you notices um every every you know every couple weeks you get a friendly little letter from the irs that says hey you owe us a lot of money cut a check now or else we're gonna chase you down and you know find you place liens on your assets levy levy your assets not good stuff so again like if you owe some taxes even if the amount is you know relatively nominal just do this installment agreement request because there's nothing that says that you can't...

PDF editing your way

Complete or edit your tax 9465 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export installment agreement request form 9465 directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your irs payment plan form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your irs installment agreement form 9465 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

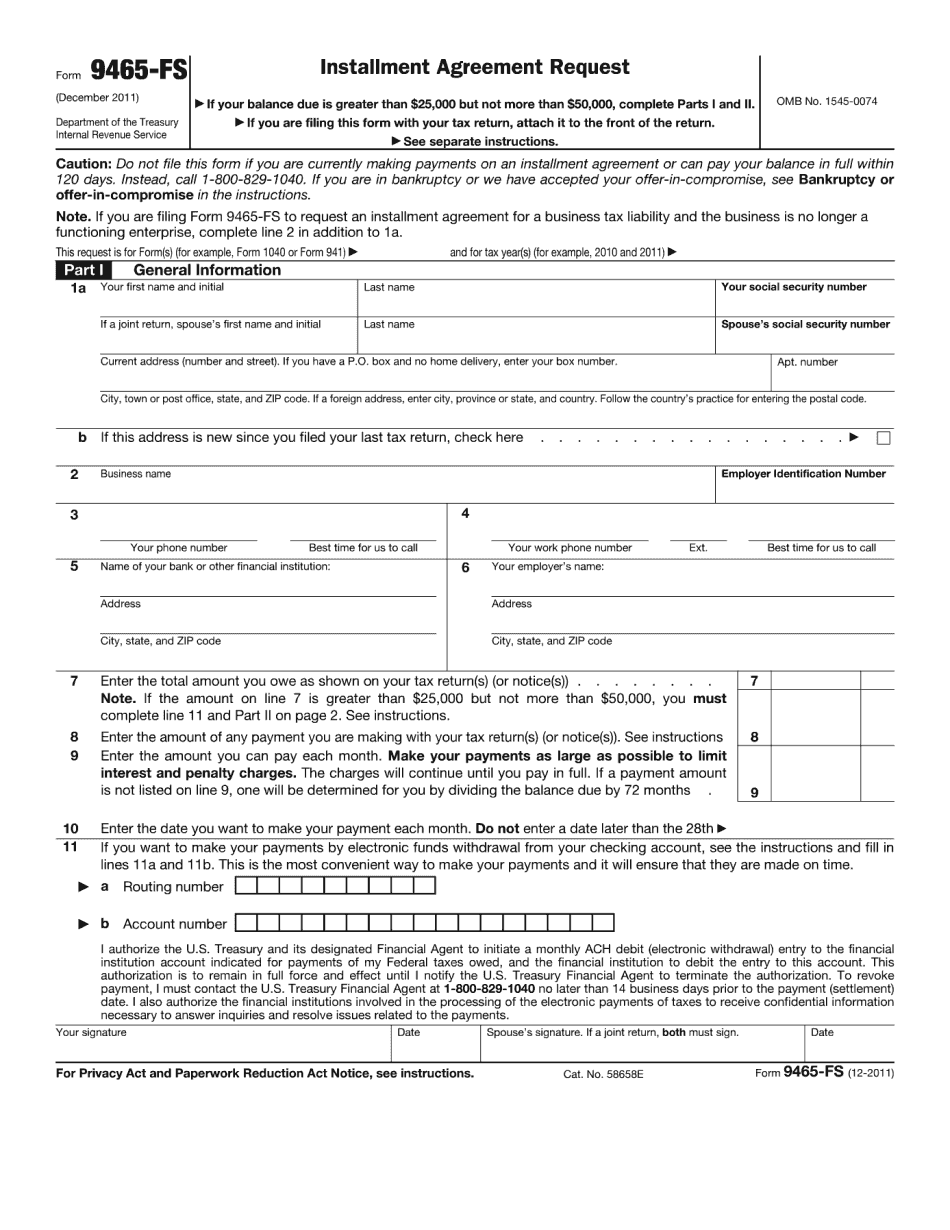

How to prepare Form 9465-FS

About Form 9465-FS

Form 9465-FS is a form issued by the Internal Revenue Service (IRS) in the United States. It is officially known as the Installment Agreement Request and is used by individuals who are unable to pay their tax liabilities in full at the time of filing their tax returns. The purpose of Form 9465-FS is to establish and request an installment agreement with the IRS, allowing taxpayers to pay their outstanding taxes in smaller, more manageable monthly installments over a period of time, instead of in one lump sum. Taxpayers who are unable to pay their tax debts in full and can fulfill the requirements stated on the form may need to fill out Form 9465-FS. This form is particularly useful for those facing financial hardships or temporary financial difficulties that prevent them from immediately paying their tax obligations in full. By submitting this form, individuals can propose a specific payment plan and negotiate with the IRS to set up an installment agreement that suits their financial capabilities. It is important to note that Form 9465-FS is not required if the taxpayer owes less than $10,000 and can pay the full amount within 120 days. Additionally, taxpayers must ensure they file all required tax returns before requesting an installment agreement using this form. Ultimately, individuals who are unable to pay their tax debts in full and wish to establish a reasonable payment plan with the IRS should consider using Form 9465-FS. This form helps taxpayers to resolve their tax liabilities in a more flexible manner while fulfilling their obligations to the IRS.

What Is Irs Form 9465?

Online technologies assist you to organize your file administration and enhance the productiveness of your workflow. Observe the brief guide in an effort to fill out Irs Form 9465?, avoid errors and furnish it in a timely manner:

How to fill out a 9465 Irs Printable?

-

On the website hosting the form, click Start Now and pass towards the editor.

-

Use the clues to complete the suitable fields.

-

Include your individual information and contact information.

-

Make sure that you enter suitable data and numbers in correct fields.

-

Carefully examine the data in the document so as grammar and spelling.

-

Refer to Help section when you have any questions or contact our Support staff.

-

Put an digital signature on the Irs Form 9465? printable with the assistance of Sign Tool.

-

Once document is done, press Done.

-

Distribute the prepared through electronic mail or fax, print it out or download on your gadget.

PDF editor lets you to make changes in your Irs Form 9465? Fill Online from any internet linked gadget, personalize it in accordance with your needs, sign it electronically and distribute in different approaches.

What people say about us

How to fill out forms without having mistakes

Video instructions and help with filling out and completing Form 9465-FS