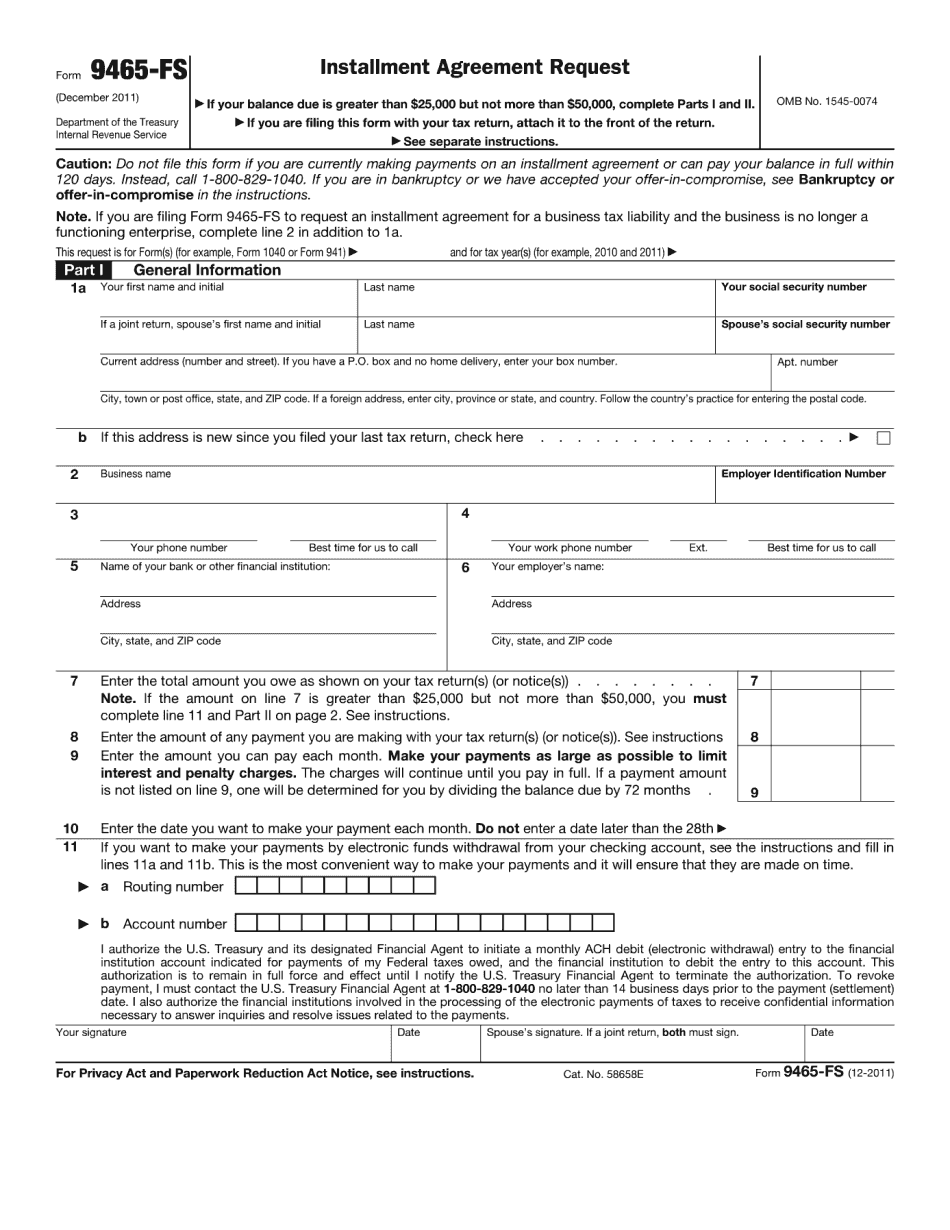

You find yourself on the IRS or state money that you cannot immediately pay. How do you resolve this to get it paid? What are your options? Hi, I'm Gary and welcome to Tax Bulldog, for the best thoughts and ideas for trimming your tax down. These videos are to help you help yourself, to avoid costly professional fees. If your situation has a level of complexity, you may want to consult a professional. These videos will at least give you an introduction of what to expect and to know when someone is just misleading you. If you feel you need help, see the video on selecting a tax professional to represent you at this link. That will put this in the description below, that will cover information on states where I can. There are 50 states, each having their own unique tax laws. While I have worked with many states in my years in this profession, they do change at times. I cannot keep up with all 50 states where it's easier with the IRS. Every time I have an interaction with a state, I update my notes on it. The information I provide in this video is not legal advice and should not be relied upon as such. All or portions of this video are copyrighted and all rights are reserved. Now, in this video, I'm going to discuss how to apply for an IRS installment agreement. I will also briefly talk about state installment agreements. With the IRS, you can apply online by calling them at 800-829-1040 or the phone number on a notice you have. Alternatively, you can mail in Form 9465. If the IRS has not been in contact with you in person, other than by mail, you can apply online by one of the methods I've...

Award-winning PDF software

How to file 9465 online Form: What You Should Know

IRS forms and enter the taxpayer's mailing address and the amount you wish to pay. Sep 21, 2025 — If you filed Form 4499 on or after August 3, 2017, the annualized interest rate on a tax installment agreement is 10% (as opposed to 3% before August 3, 2017). To help you estimate how much interest you can save by using Form 4499 installment agreement, see How To learn more about how The Form 4499 installment agreement option is not for installment agreements for prior years. Sep 27, 2025 — If you want a payment agreement because of an overpayment, you will be able to apply for an extension or get a refund if you file a Form 8379. Form 8379 — Overpayment of Tax by a Payroll Agent You are required to use this form if you made an unauthorized contribution to your IRA. What You Must Do Complete all information about the payment arrangement, including the mayor, the payoff amount, and the amount due and paying each month. This summary does not include information you would need to provide when requesting a payment agreement online. Complete your payment arrangement in e-filing. You can use Form 9465 for each payment agreement you receive. The final Form 9465 payment will not be delivered in a mailed envelope. It is mailed to the mayor's mailing address listed on the payment agreement. After your payment is complete, contact the mayor to resolve any issues. Form 8379.pdf (4.8 MB) What You Cannot Do You cannot use your tax return for a payment agreement if it is incomplete (you or the payee do not have enough information to complete Form 9465). The payment agreement must be complete and accurate, as well as a reasonable approximation of the payment due date. This includes the mayor's name, mailing address, and electronic payment methods. The payment agreement must be a tax installment agreement for federal income tax or social security tax, or an electronic fund transfer agreement for federal income tax or social security tax with an authorized electronic fund transfer transaction (“EFT”). The payment agreement needs to be a written agreement between you and the payer. It must not be a verbal agreement. The payer (the person you have agreed would pay the balance due) cannot be a bank, a financial institution, or another person. You should not pay this amount into the payee's account.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9465-FS, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9465-FS online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9465-FS by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9465-FS from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How to file Form 9465 online