Award-winning PDF software

Irs installment agreement online Form: What You Should Know

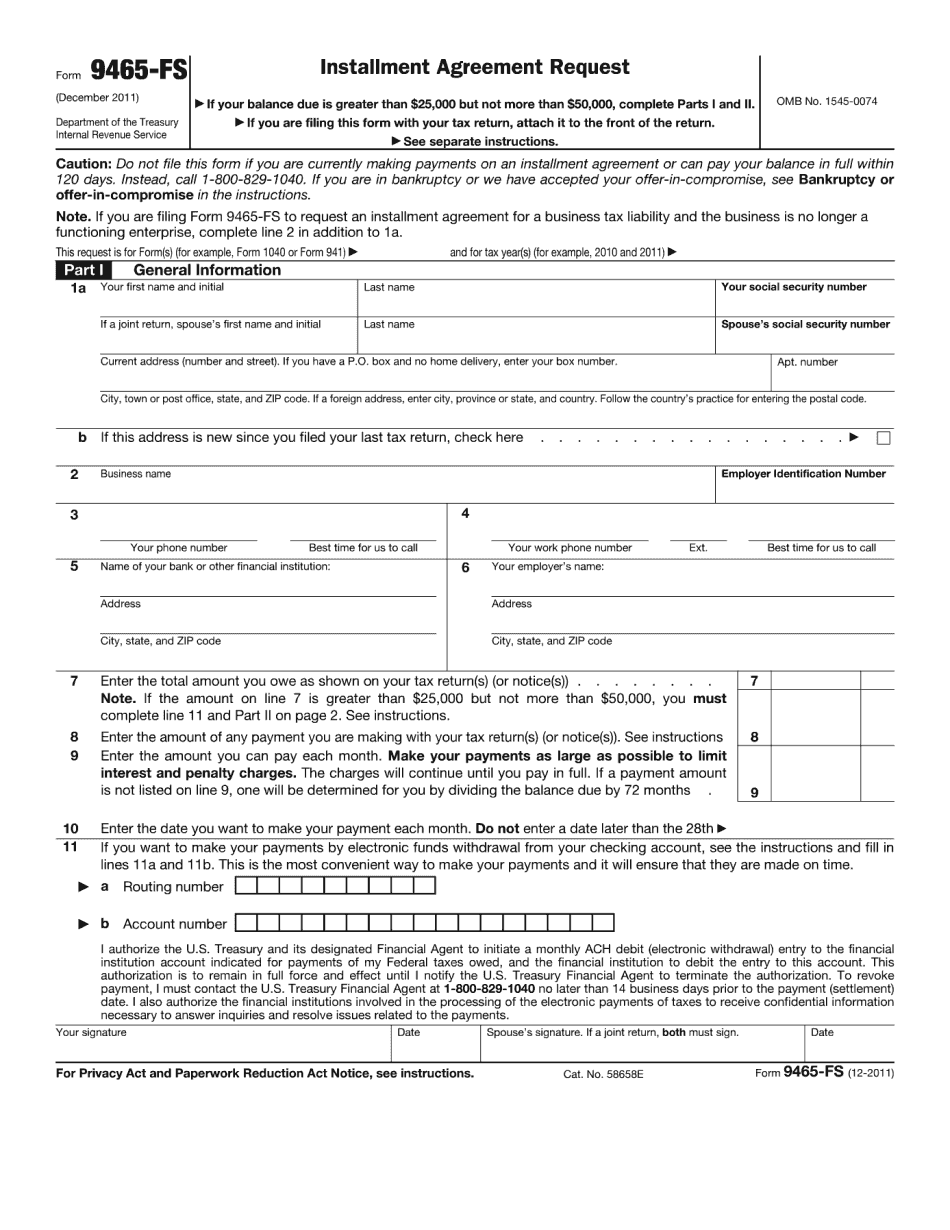

Aug 27, 2025 — Submit a written request to the IRS by mail or by telephone (by mail or phone) requesting an installment agreement. Installment Agreement — Internal Revenue Service Aug 27, 2025 — You must use the Installment Agreement. (See above and on-line instructions) Installment agreement. (See above) Installment plan application for tax year 2022. (See instructions on the back of this page) Installment plan application, notice. (See instructions on the back of this page) A tax year can be up to 6 months long. (The 2025 tax year is a 1-year extension on the payments you'll make.) The installment agreement allows you to pay each installment over the course of a 12-month period, from the date we send you the payment. You will need to do some basic math: First, find out the amount of the installment you would like to make. Then figure out what the total number of consecutive payments you're scheduled to make, and total your payments. For example, if you want to pay 200 each month from July 1, 2017, through December 31, 2018, multiply 200 by 4. (We'll round the payment amounts to the nearest whole dollar.) We'll tell you how much to pay toward your balance. This is how much to pay before you do your tax return each year. If you pay any amount toward your balance, it reduces the amount you owe. Doing your tax return, filing the return, and then paying any other tax penalties and interest must all occur within the 12-month period during which you're supposed to do the installments (this is the installment period). You could get a tax credit for this payment. We'll let you know you've been approved for an Installment Agreement by contacting you at the account you've established with us. If we agree to your request, we'll mail you a Notice of Approval for Installments and a Notice of Refund for Payee Payments, stating what is being done and requesting your approval within 5 business days. These notices tell you how to use the on-line filing system in order to apply for any future installments, including the installment agreement if we agree. If you don't get this confirmation, don't worry about it. If you contact us with questions, we'll try to help.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 9465-FS, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 9465-FS online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 9465-FS by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 9465-FS from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.