Award-winning PDF software

Form 9465 - Installment Agreement Request - Taxslayer Pro Support: What You Should Know

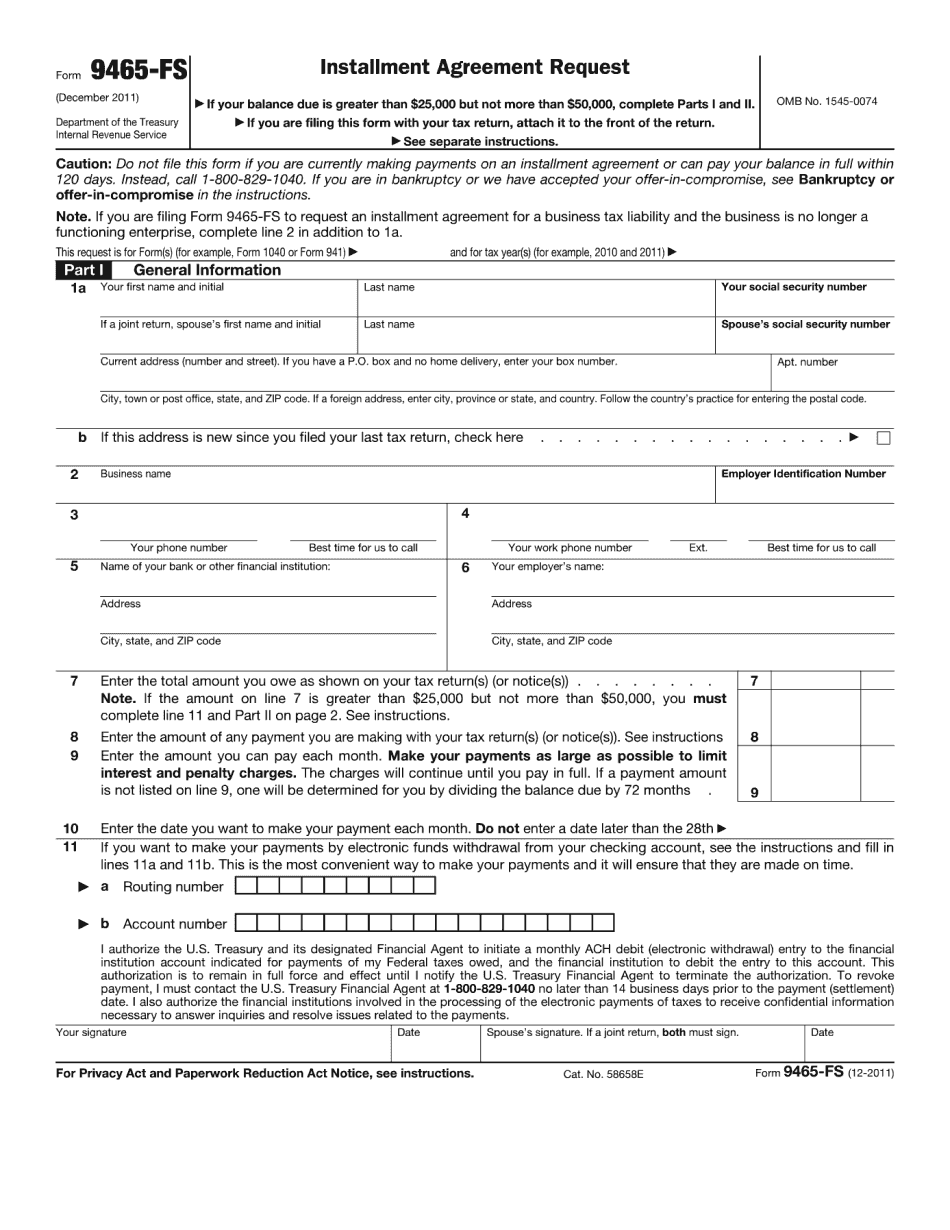

Note: You must pay the payment due on the day that a final installment appears on your statement. You can pay electronically using the Pay by Check option. Form 9465 is a tool that you can use to request a monthly installment plan that allows you to make installment payments and has monthly taxed payment reminders. You must complete Form 9465 and pay any amounts you owe at least once per month. Instructions for completing Form 9465 for a Monthly Installment Agreement: For a Single Taxpayer For a Head of Household Taxpayer Instructions for completing Form 9465 for a Monthly Installment Agreement: This form is not to be considered official IRS documentation and is not intended to serve as your personal tax return. All information provided on this form should be used for your own personal tax consideration only. Filing the Installment Agreement — IRS Include all required attachments to complete Form 9465 (i.e., W2, 1140, or 1099) and attach Form 9465 to your return. Reasons to Filing Monthly Installment Agreement If the payments you make on your monthly installment plan are less than your total tax liabilities on your tax return, you can claim you did not pay enough taxes. If you don't pay before the due date of your tax return, you could lose your right to file Form 1040. You can make a full payment (at least 3 months prior to the due date) and receive a “no payment” notice for the tax period you did not pay. If you are currently paying the full amount due under the installment agreement and your taxes are less than you owe, you can use the payments to reduce the federal income tax liability shown on this form. For example, if the installment agreement required you to have paid a total balance of 1,600, and you have only paid 1,000, then you have 300 less to pay after you are no longer required to file. If you want to get a tax refund, you will be taxed on the amount on the installment agreement payment that is greater than the refund due. If you want to make a payment to an unrelated tax account, you will be taxed on that amount on your payment statement. If the account is not listed, write down the account number, and make a payment to the other account. This form is not considered official IRS documentation and is not intended to serve as your personal tax return. Please keep this document for your records.

Online methods make it easier to to prepare your document management and supercharge the productiveness of your workflow. Observe the short information to be able to full Form 9465 - Installment Agreement Request - TaxSlayer Pro Support, refrain from errors and furnish it in a very timely fashion:

How to complete a Form 9465 - Installment Agreement Request - TaxSlayer Pro Support on the internet:

- On the website while using the type, click on Initiate Now and move to your editor.

- Use the clues to complete the related fields.

- Include your own facts and phone data.

- Make convinced that you enter suitable facts and numbers in suitable fields.

- Carefully verify the subject matter from the kind also as grammar and spelling.

- Refer to assist segment when you've got any concerns or address our Service team.

- Put an digital signature with your Form 9465 - Installment Agreement Request - TaxSlayer Pro Support with the support of Indication Tool.

- Once the shape is accomplished, push Completed.

- Distribute the prepared sort through e mail or fax, print it out or help you save on your equipment.

PDF editor will allow you to make adjustments to the Form 9465 - Installment Agreement Request - TaxSlayer Pro Support from any online world connected gadget, customize it in accordance with your preferences, sign it electronically and distribute in different approaches.