Award-winning PDF software

Form 9465-FS for Allentown Pennsylvania: What You Should Know

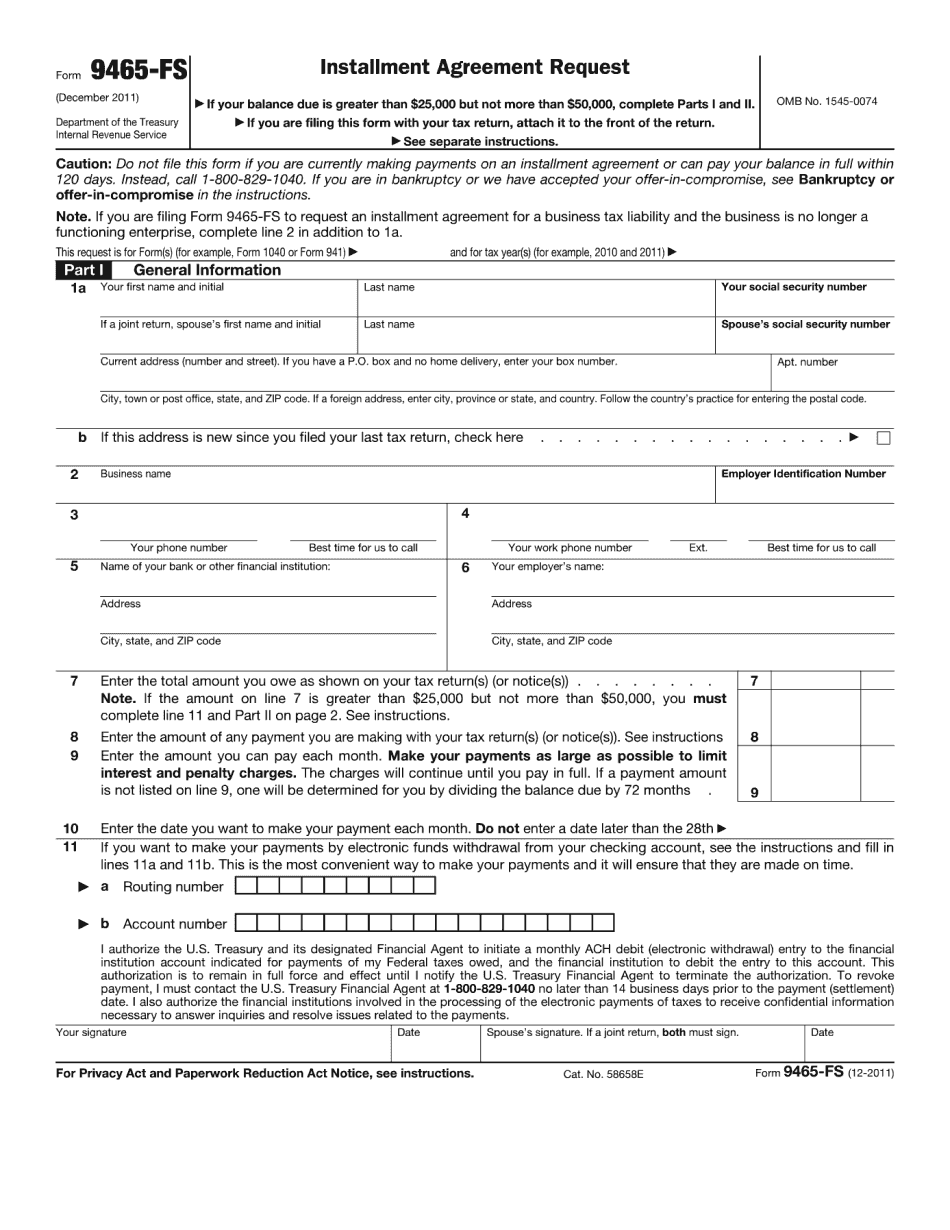

The taxpayer is not required to pay any tax for a period of 10 years beginning on the date of the agreement. The agreement can be pursued up until the date of the original delinquent tax return. Form 9465-FS Withdrawal — Pennsylvania State Use Form 9465-FS to request an abandoned tax form. The purpose of the abandoned tax form is to allow the taxpayer to withdraw his or her entire tax liability without penalty for a period of up to 14 years after filing of Form 4621, which is generally due on April 15, 2022. The reason for the withdrawal is to protect against fraud. Form 965 — Pennsylvania Allentown County Government Allentown City-County Government Allentown Township Tax and Development Agreement PA Law Chapter 476, Subchapter VI Form 965 Withdrawal — PA State Allentown County Government City of Allentown Township Tax and Development Agreement PA Law Chapter 476, Subchapter VI Pennsylvania Business License Apply online to register and obtain business license for the tax year in which you want to report to the IRS. Click the blue button “Business Licenses” at the top of the home page. The online registration process has one requirement: An EIN. Enter the EIN for each business you want to register. The EIN can be downloaded under “Taxpayer Information” and is automatically sent to the Pennsylvania State Division of Taxation. Please check the address given for processing purposes and in the event of a tax due in the future. Allentown City-County Government City of Allentown City of Allentown Township Tax and Development Agreement PA Law Chapter 476, Subchapter VI New Guidance on Use and Transfer of Property — For Taxpayers With A Leased Business Revenue PA and the Revenue Processing Service will soon revise their guidance regarding whether property that is part of a business that is currently owned by a taxpayer can be owned by the taxpayer only until the taxpayer enters into a sale-leaseback transaction with the lessee. In most jurisdictions, if the property is owned by the taxpayer, the taxpayer continues to own it. However, when the property is leased, the tax assessment of the property is reduced.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9465-FS for Allentown Pennsylvania, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9465-FS for Allentown Pennsylvania?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9465-FS for Allentown Pennsylvania aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9465-FS for Allentown Pennsylvania from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.