Award-winning PDF software

Form 9465-FS for Carlsbad California: What You Should Know

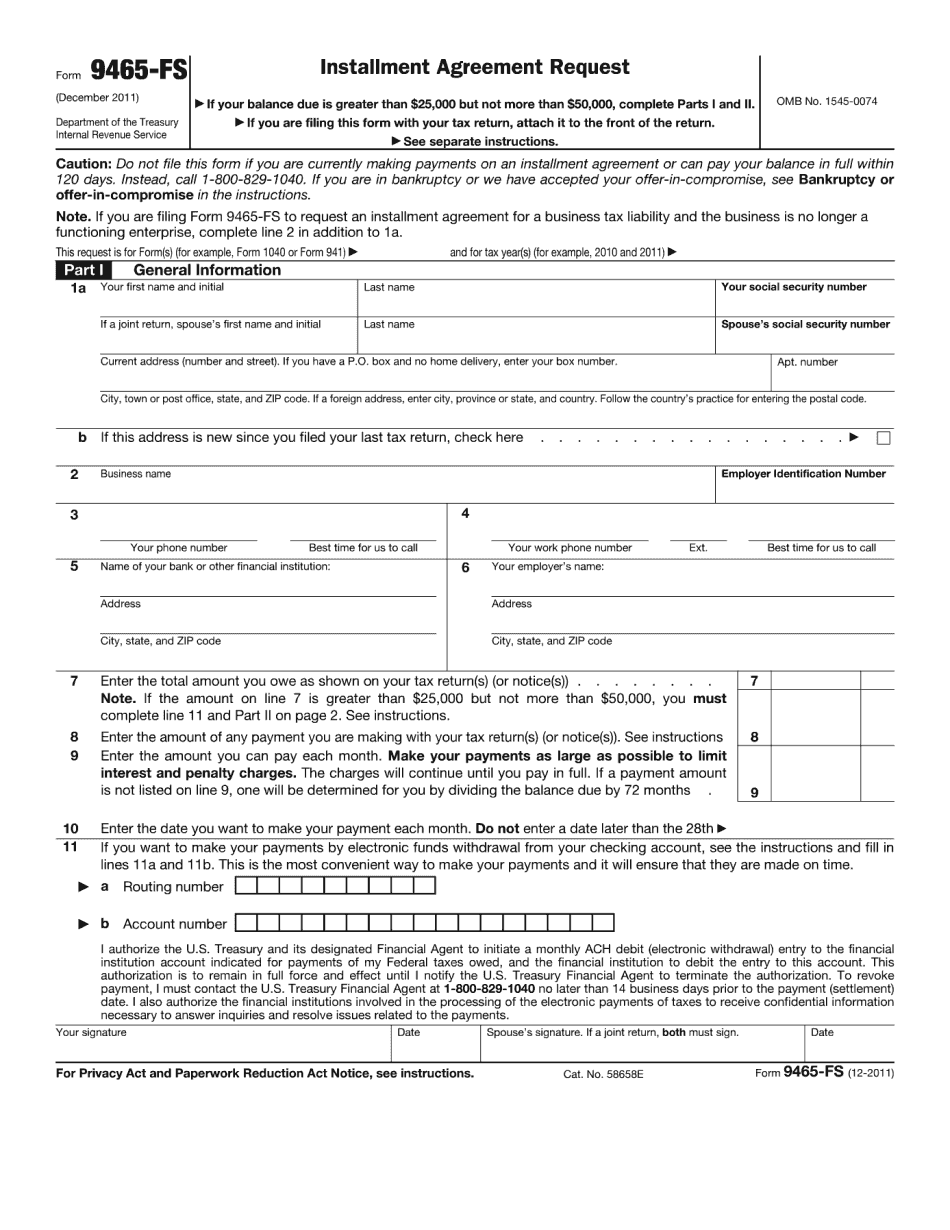

IRS. Gov/forms/form9465. Using your installment agreement, you can ask the IRS to allow you to settle delinquent tax debts without having to pay interest and penalties. More on how to use an installment agreement to settle a tax debt from our Tax Tip of the Day column on January 18, 2002. Learn more about IRS Tax Tip 507, which will tell you if you can use a payment arrangement through the IRS to pay part or all of your federal taxes. IRS Notice 2008-55 — Settlement of Federal Tax Delinquencies The IRS has a form that you can use to file a Notice of Levy, Collection, or Penalties to obtain money owed the government and to obtain a cash payment from the tax debtor. A Notice of Levy, Collection, or Penalties to the IRS Use the Notice of Levy, Collection, or Penalties to the IRS form to file your claim and get a cash payment. You must send us your claim and payment to: United States Treasury Attn: Special Litigation Operations 200 Constitution Avenue, S.W. Washington, DC 20410 IRS Notice of Levy, Collection, or Penalties (Form 4868).pdf See IRS publication “How to Use a Notice of Levy, Collection, or Penalties” for more information. Use IRS Offer in Compromise (Form 5500) If you do not get a cash payment, you may be able to work out a settlement of your tax debt with your tax preparer. A settlement of your taxpayer liability may result in your taxpayer balance being reduced. See IRS publication “What to Do if you Can't Pay Your Tax Bill” for more information. Go to to find out if your tax debt would qualify for a settlement. You can also call. Using IRS Offer in Compromise (Form 5500). A settlement may result in you paying only a portion of your tax liability. You only owe the federal tax liability plus interest and penalties, and you must be sure the state tax is paid before you file a petition for reduction of tax. See IRS publication “Offer in Compromise, Reduction of Tax, and Tax Refund” for more information. Go to . Use IRS Offer in Compromise (Form 5500).

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9465-FS for Carlsbad California, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9465-FS for Carlsbad California?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9465-FS for Carlsbad California aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9465-FS for Carlsbad California from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.