Award-winning PDF software

Form 9465-FS online Arvada Colorado: What You Should Know

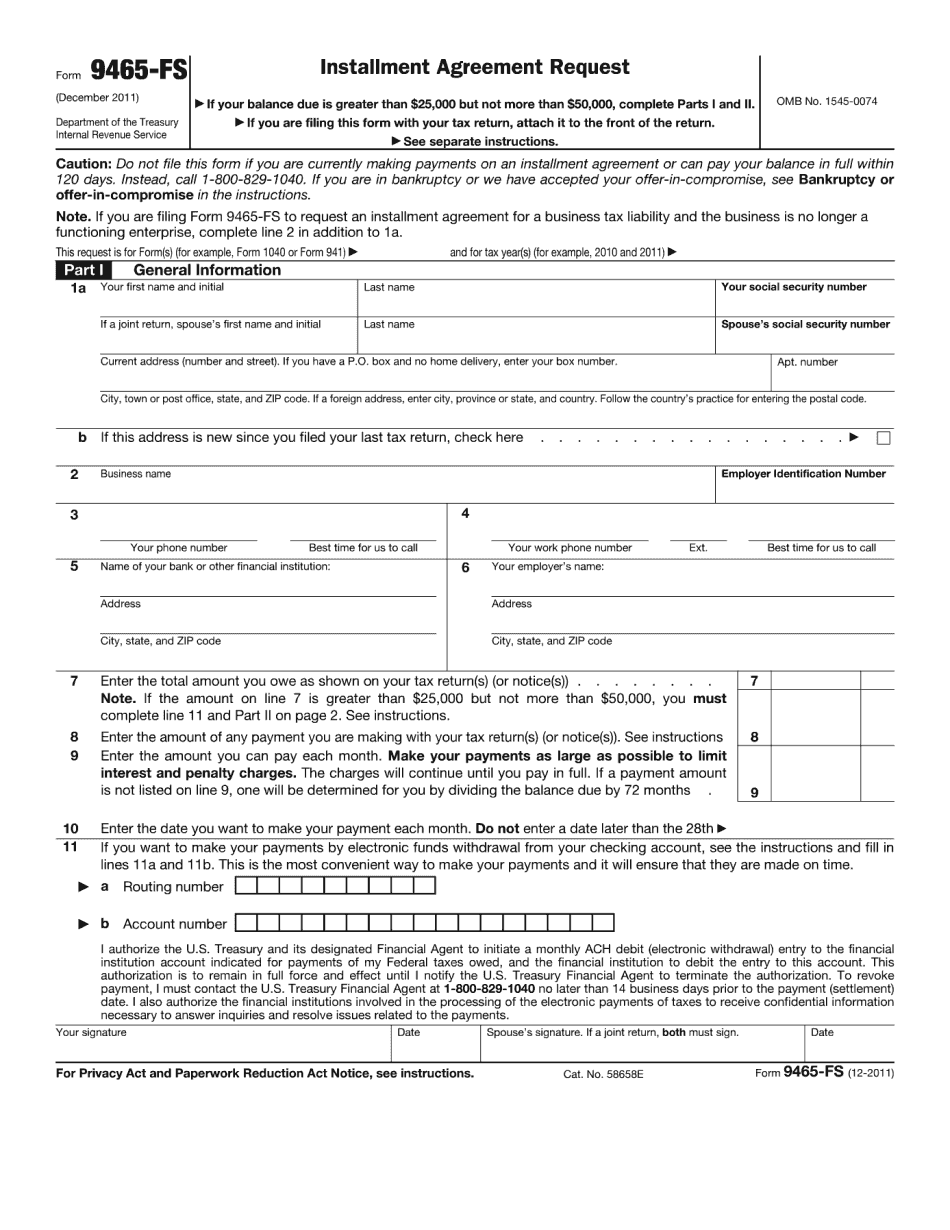

Taxpayers with Forms 9465 for Form 9465A should contact Arvada Colorado, or eSmartTax at to obtain an services Agreement form. The services Agreement is available from smart Tax. If you have any other questions about the Arvada tax form, please contact the City of Arvada Tax Department at or at . Arvada Colorado State Sales Tax Effective December 1, 2017: All forms of taxes levied by the city of Arvada on the sale of tangible personal property, services, or activities to qualified customers, regardless of when the sale take place, are subject to tax at 8.05 percent of the selling price. Qualified customer means a seller of tangible personal property, services, or activities that is subject to tax at the 8.05 percent rate. Qualified customer for tax in 2025 will be determined under Title 35-A, Article AIIC. In order for qualified customer to be subject to sales tax, a qualified customer must meet the definition of “salesperson” as set in Title 35-A, Article AIIC, Subtitle B. Qualified customer who is qualified under Article MINICAB and does receive at least 20,000 in merchandise sales per tax year are qualified customers. Qualified customer whose business does, at a minimum, have gross revenue of 100,000 per year, is also a qualified customer. “Qualified customer” does, however, include vendors of tangible personal property, services, or activities, if they have gross receipts of 100,000 or less. There is a 1000 maximum amount for sales of 1,000,000 or less. For Qualified Customer Tax, it is more important not to be in arrears or have any outstanding balance than it is to be in the top 20 percent of all taxpayers in the county. The following information applies to the sale of tangible personal property, services, or activities to qualified customers. The amount of tax due will be determined according to the sales tax rate schedule. Any amount over the total tax liability calculated as a percentage of the sales price will be treated as interest on the arbitrage under Section 4.02 of Title 35-A, Article AIIC.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9465-FS online Arvada Colorado, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9465-FS online Arvada Colorado?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9465-FS online Arvada Colorado aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9465-FS online Arvada Colorado from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.