Award-winning PDF software

Form 9465-FS AR: What You Should Know

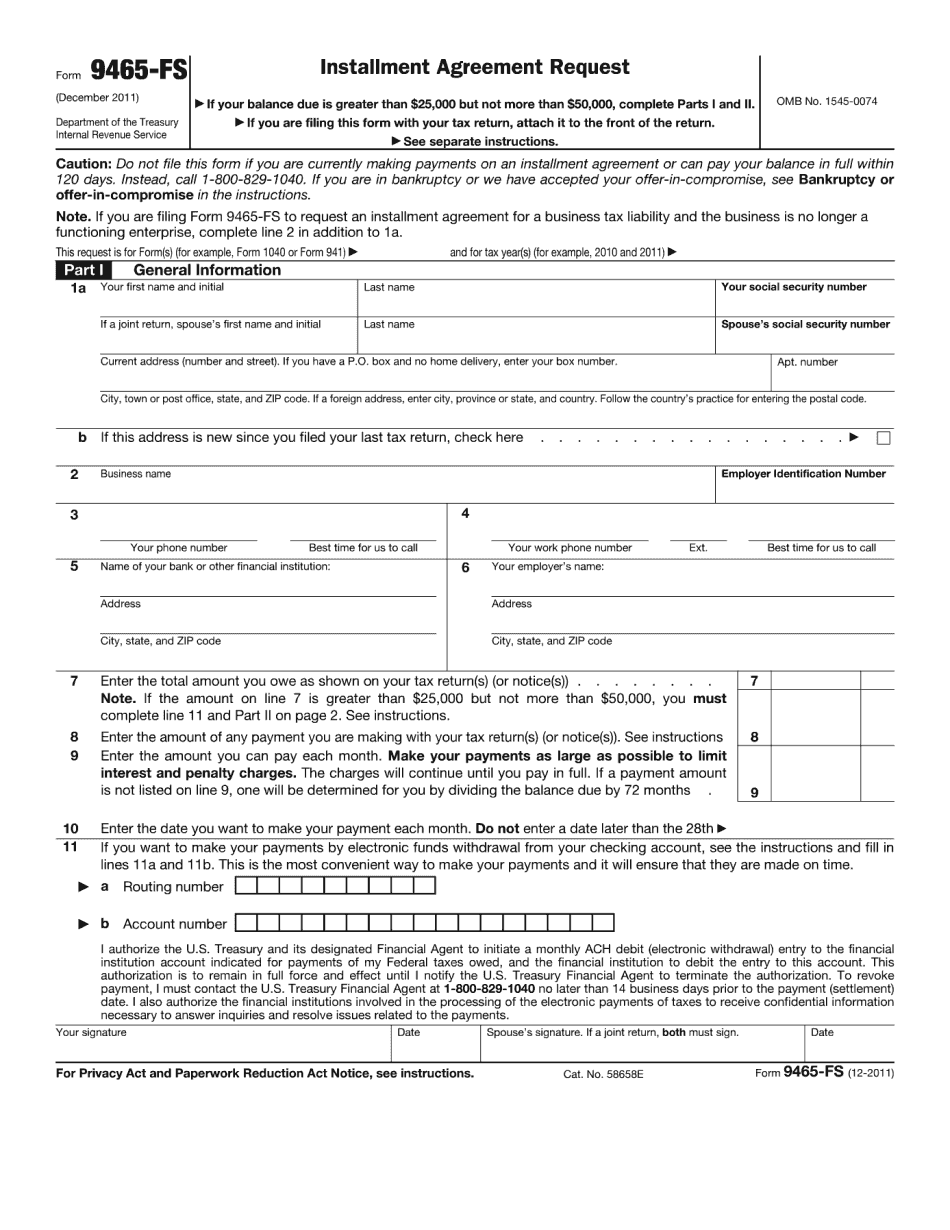

Fort Smith, AR 73033. FEDERAL RESERVE OFFICE OF THE ATTORNEY GENERAL, AT THE STATE CAPITOL ABOVE THE White House. In a memo to all state offices, Deputy Attorney General Lenny Hayes said the U.S. Treasury will be providing a new online format starting February 13, 2022. The e-application will let employees file tax returns under either federal or state law using a single, secure online portal. The website also will make it easier for employees to file and pay their taxes online instead of calling a tax office or other tax-related agencies. The e-format also could make it easier to manage paperwork and file correct forms. “Because we're introducing a new, secure way to file, we are also creating a new way to manage paperwork,” Deputy Attorney General Lenny Hayes said from Washington, DC. “The more information we can provide to employees, the faster and more efficiently they can file. I believe people will use this new e-filing platform because it's easier and quicker.” To submit Form 9465, use the online Form 9465 at the federally Portal online application. Applicants must enter their Social Security Number, date of birth, and last four digits of credit or debit card account balance and must enter their last and current address, mailing list and contact phone numbers. This is the same information required for other federal, state and local tax filings. IRS is offering a free one-year subscription for up to 100 IRS e-file users, the IRS said. IRS said the system will support multiple states. More About IRS e-Filing System — IRS Use the web Form 9465, Installment Agreement Request, to request a monthly installment plan if you cannot pay the full amount you owe shown on your tax return (or on a notice we sent you). You can also apply by mail using the federal form 9465-FS, Installment Agreement Request. IRS said the system will cost 3.95 per tax return or 5.95 per additional Form 9465, up to one million tax returns per year. U.S. Supreme Court Decisions: 18 July 2025 — When the IRS uses “unjustified financial hardship” as the excuse to seize a debtor's property, the court often finds that there was no good reason for the seizure.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 9465-FS AR, keep away from glitches and furnish it inside a timely method:

How to complete a Form 9465-FS AR?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 9465-FS AR aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 9465-FS AR from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.